ABOUT THE REGISTRIES FOR MOVEABLE SECURITIES

-

HISTORY

Based on the law on non-possessory pledge that was passed in 2009, the Directory of Registries for Moveable Securities (DRMS) was established within the General Tax Directory (GTD).

Its mission is to establish and manage the registration system of the Moveable Securities. Operational since 2011, the DRMS provides its on-site registration service from its office in Port au Prince. The registration processe was rather manual and was not efficient in serving the financial system, given the development of technology that the DRMS could benefit.

With technical and financial assistance of the World Bank Group, an online registration system was set up in 2019. This new state-of-the-art system allows institutional members across the country to connect directly to the DRMS to register online and the operation could be completed in few minutes.

-

VISION

The Directory of Registries for Moveable Securities undertakes to become, in the fairly near future, a management concerned with the security and transparency of moveable securities. And as such it aims to be modern, anticipating the new information and communication technologies.

-

THE MISSION

The Registry is established for the purpose of receiving, maintaining and making available to the public continuous information in registered notices regarding moveable securities.

-

SOME IMPORTANT DATES

-

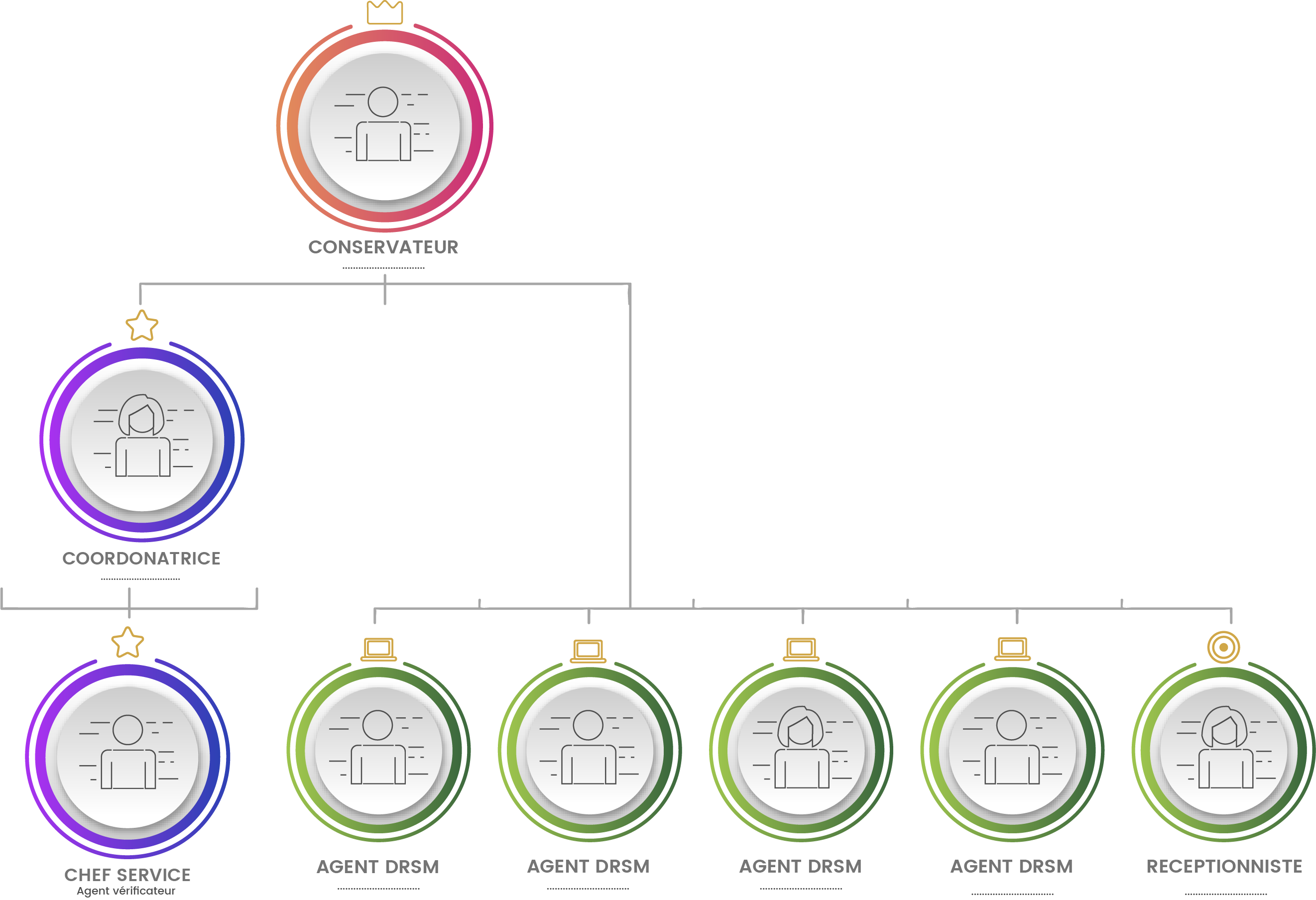

THE ORGANISATION OF THE DIRECTORY OF REGISTRIES FOR MOVEABLE SECURITIES

-

WHAT IS THE PURPOSE OF THIS SITE ?

CThis website is where you will find the Registry of Personal Property Security Interests of Haiti. This is where you will register notices of security rights in movable property (encumbered assets) and seek notices of other existing security rights.

If you have agreed to take a security interest (a pledge or charge) in a person's (the debtor's) movable property to secure his or her obligation to you (usually a repayment obligation), you can register a notice here to inform others of your security interest. To verify the existence of prior security rights in encumbered assets available to you as security for an obligation, you can consult the Registry's records on this website.

In a typical situation under the Act, a person (the debtor) contacts a lender (secured party) to apply for an operating loan or line of credit. The debtor may offer the secured creditor a security right in the person's equipment, inventory, accounts receivable or other property.

The lender would first search the Internet Security Registry to see if the assets offered as security are subject to a prior security right. The search usually focuses on the name of the debtor, but if the proposed encumbered asset is a motor vehicle, the search must also include the serial number or identification number of the motor vehicle. If there is no prior notice of a security interest in the proposed security interest, then the secured party can enter into the loan agreement with the debtor in confidence as to its priority in the security interest against other lenders. The secured creditor would like to register its own notice of security interest in the guarantee before paying the proceeds of the loan.

If the potential lender discovers in its search that a notice of security right in the proposed encumbered asset has already been registered by another person, it has several options. The prospective lender may contact the previous secured creditor to determine whether the existing obligation is small enough to ensure that the excess value of the collateral is sufficient to secure the proposed loan, and then register its own notice of security interest (in this case, the second person to deposit would have a secondary priority in the collateral). Conversely, the prospective lender may attempt to obtain an agreement with the prior secured creditor to subordinate (secondarily) the prior security right to the security right of the current secured creditor, and then register a notice. Or the secured creditor may simply decide not to lend because of the presence of the prior notice because the credit risk of the prior security interest is too high.

Users should also use the Registry when you buy movable property - especially if you are buying something second-hand. If you purchase movable property subject to a security interest, the secured creditor may be able to repossess the property from you.

When you purchase movable property under a hire-purchase agreement or use movable property as security for a loan or other type of credit transaction, the secured party will probably register the details of the security right in the Personal Property Security Registry. This data includes some of your personal data, as a debtor. In particular, your name, address and Tax Identification Number (Tax code) will appear on the registration form.

The information recorded will also include a description of personal property. The Personal Property Security Registry records the financial details of the transaction, such as the amount borrowed or the value of the personal property.

-

WHY REGISTER OR SEARCH?

The purpose of registering a notice of security right is to establish a creditor's priority rights over a debtor's encumbered asset. The first creditor who registers a notice will almost always have priority over all other creditors in the event of default by the debtor (borrower). As a result, if a prior security right is registered, a current potential creditor (or buyer) may not obtain priority (or title proper) over the movable property given as security (or sold) and may wish to reconsider its business transaction. Therefore, the purpose of searching the files of the Personal Property Security Registry is to discover whether there may be a pre-existing security right in a debtor's assets.

-

WHERE IS THE REGISTER LOCATED?

The DRSM (Direction du Registre de Suretés Mobilières) is the designated registration office for the Security Interests Registry. However, in reality, all commercial transactions (other than direct payment) with the Registry are conducted online through this website and the DRSM has only administrative responsibilities.

Payment is made at the BRH counter pending the implementation of the Ministry of Finance's centralized electronic payment system.

If you have any questions or need help navigating the website, you can contact the GHHR Office or by clicking on the "Help" link on the home page of the website.